Exploring the World of Sub-Sale Condos in Singapore

For those unacquainted with the intricacies of real estate transactions, the term “sub-sale property” may sound unfamiliar. However, fret not, as we delve into the realm of sub-sale condos in Singapore to shed light on this intriguing aspect of the property market.

So, what exactly are sub-sale condos in Singapore?

According to the Urban Redevelopment Authority (URA), the definition of a sub-sale is as: The sale of a unit by one who has signed an agreement to purchase the unit from a developer or the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

In other words, a sub-sale property is when the original buyer bought a new launch property but wishes to sell it to another buyer before the unit is completed and is ready to move in soon.

How is sub-sale still relevant in 2023? Would anyone consider investing in sub-sale properties?

The answer lies in the unique opportunity that a sub-sale condo has to offer. By investing in sub-sale condos, astute buyers can potentially reap the benefits of property appreciation even before its completion. This means that savvy investors can capitalise on the value appreciation of newly launched properties without having to endure the waiting game!

What is Seller’s Stamp Duty (SSD) and why it’s important?

SSD is a property tax that a property seller has to pay when he/she sells a property within the 3-year holding period (number of years that you own a property).

When it comes to maximising profit from a property sale, it’s crucial to consider the implications of Seller’s Stamp Duty (SSD). By understanding the SSD rules and strategically timing your property sale, you can optimise your financial gains.

For those looking to fully maximise their profit from a property, waiting out the full 3 years becomes a prudent strategy. It provides an opportunity to leverage the potential appreciation of the property over time without incurring additional costs associated with SSD. Timing the property market is also an essential key to a successful investment. Being mindful of the SSD implications and strategically planning your property sale, you will reap the rewards of your investment to the fullest extent possible and avoid paying unnecessary fees.

So, why do sub-sales happen?

Sub-sales often come about due to various reasons, driven by both personal circumstances and financial considerations. Let’s explore some of the common motivations behind these transactions.

- A Shift in Buyer’s Finances: Life can be unpredictable, and unforeseen circumstances sometimes necessitate a change in plans. For instance, the global COVID-19 pandemic has brought about financial hardships for many individuals. In such cases, selling a recently purchased condo through a sub-sale allows individuals. In such cases, selling a recently purchased condo through a sub-sale allows individuals to secure their financial well-being amidst challenging times.

- Capitalising on Capital Gains: Sub-sales can offer financial benefits, but it’s important to note that making significant profits through this method of real estate transaction may not always be a guaranteed outcome. However, there are certain scenarios where the potential for substantial gains exists:

- Property Boom: During periods of booming property values, the market experiences a surge, creating exceptional investment opportunities. Astute buyers who enter the market at the right time can capitalise on substantial appreciation and realise significant profits.

- Exclusive and Desirable Units: Some sub-sales involve highly sought-after units within exclusive projects that have been completely sold out. These properties often boast ideal views and features, making them highly attractive to potential buyers.

- Acquiring Below Market Value: In certain instances, buyers manage to secure a fantastic deal on a unit, obtaining it for significantly less than its market value directly from the developer. This advantageous purchase sets the stage for potential future gains.

As the dynamics of the real estate market continue to evolve, understanding the underlying factors driving sub-sales is crucial for both buyers and investors. By recognising the motivations behind these transactions, individuals can navigate the market with greater insight and make informed decisions that align with their goals.

The Risks and Rewards of Sub-Sale Investments

While sub-sale properties can offer compelling investment opportunities, it’s critical to understand that profits aren’t guaranteed. Like any investment, profitability depends on several factors, including timing and prevailing market conditions.

Moreover, the property’s unique attributes, such as its location, design, and surrounding amenities, also play a vital role in determining its appreciation potential. Investors should conduct thorough due diligence, carefully evaluating the market conditions and property attributes, before venturing into a sub-sale investment.

When it comes to sub-sale condos in Singapore that have exceeded all expectations, there are certain properties that stand out, offering the potential for remarkable returns. Investing in these properties can be a game-changer, paving the way for impressive gains over the years to come.

Here are some notable sub-sale condos that have proven their worth:

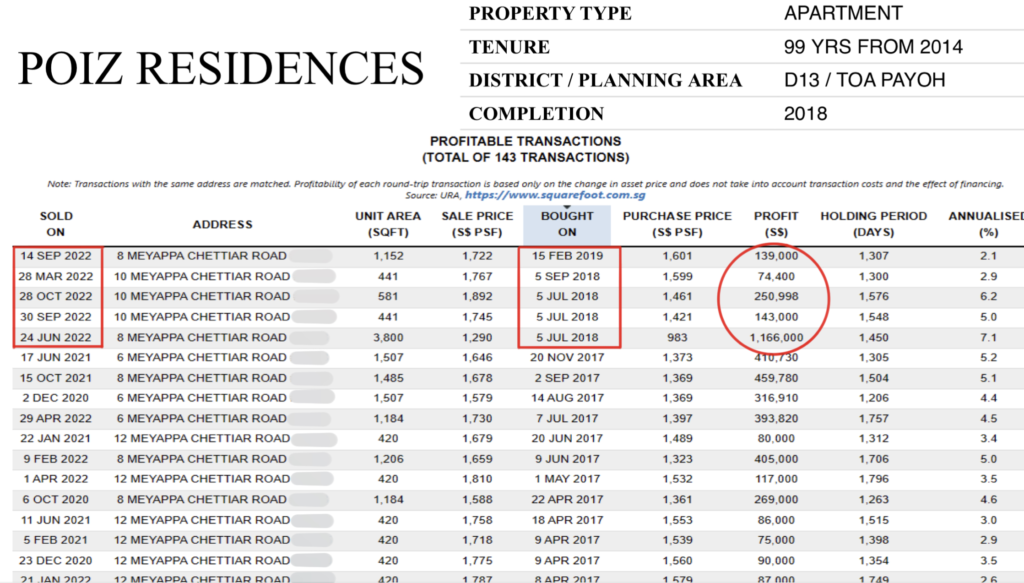

Poiz Residences

Another standout property, Poiz Residences, has captured the attention of astute investors. With its unique blend of modern design, convenient amenities, and desirable location, this sub-sale condo presents an enticing opportunity for those looking to maximise their returns.

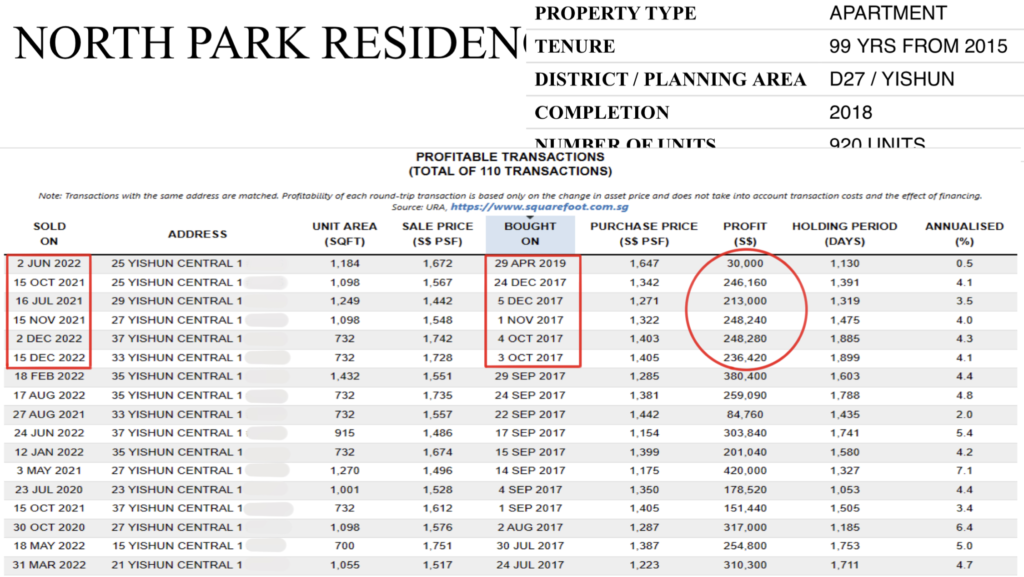

North Park Residences

Situated in a prime location, North Park Residences has emerged as a top contender for investors seeking substantial profits. Its strategic positioning and attractive features make it a property not to be overlooked, as it holds the potential for remarkable performance.

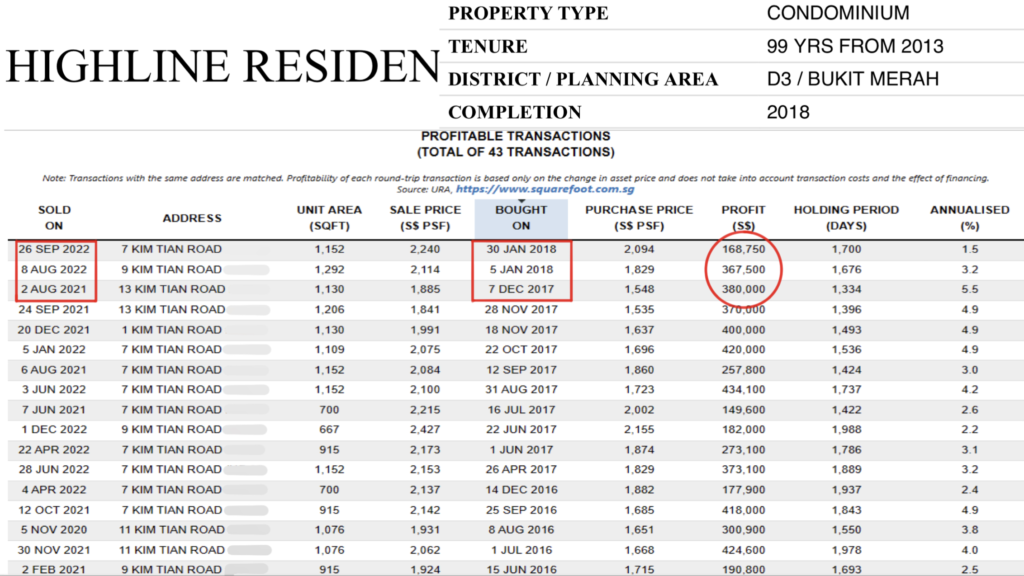

Highline Residences

Offering an exquisite living experience, Highline Residences has gained a reputation for its upscale appeal and exceptional value. Investors who focus their attention on this property, particularly on its larger units, can anticipate significant success in their financial endeavours.

By diligently researching and investing in sub-sale condos like such, along with the right mix of patience and perseverance can set themselves on a path towards early retirement and financial freedom. In fact, the potential for generating profits surpassing a million dollars is within reach for those who navigate the market wisely.

Capitalising on Early-Bird Discounts in Sub-Sale Investments

A pivotal strategy to enhance the potential profitability in sub-sale condos is to be among the first wave of buyers. Often, developers offer enticing discounts and promotions to early investors to gain momentum in sales during the initial phase of the project.

Being an early bird in property investments, particularly in sub-sale condos, can result in substantial savings. When combined with the right market timing, this can substantially enhance the profitability of your investment.

It’s important to keep in mind that these discounts are usually more prominent during the initial launch phase. As the project progresses, developers may scale back these incentives. Therefore, being an informed investor and acting swiftly at the outset can be a game-changer in maximising your returns in sub-sale investments.

However, it’s also essential to exercise caution and conduct thorough research. The allure of early discounts should be balanced with due diligence on the property’s attributes and potential market trends, to ensure a well-informed investment decision.

We hope this comprehensive guide enhances your understanding of Singapore’s sub-sale condo market, its workings, potential rewards, and associated risks. If you have further queries or need professional guidance, feel free reach out to our dedicated team of experts! Remember to visit our website for more enlightening guides, as we continually aim to assist you on your real estate journey.